carried interest tax uk

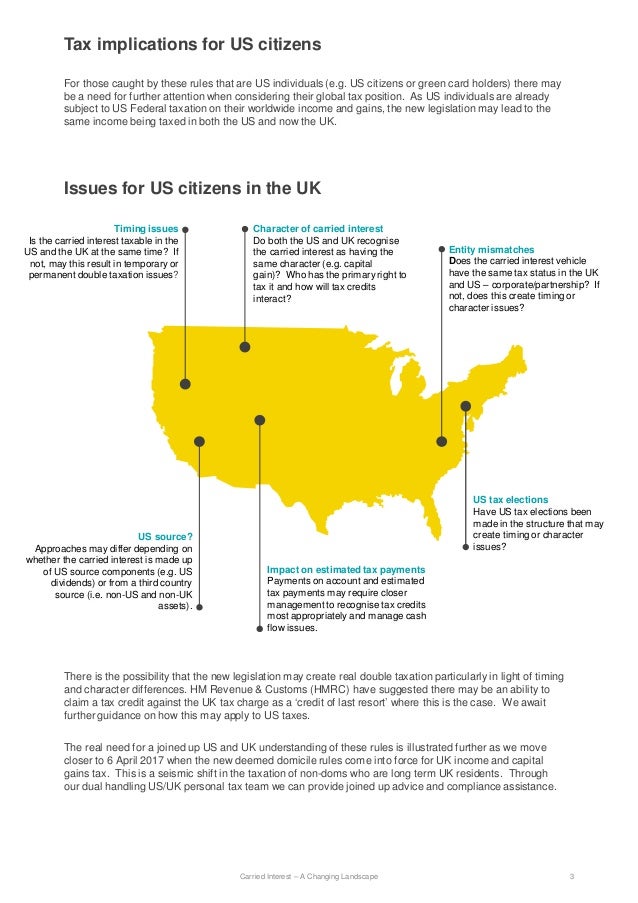

The introduction of the Disguised Investment Management. Income Based Carried Interest IBCI which is subject to income tax and NIC and carried.

Guide To Crypto Taxes In The United Kingdom Tokentax

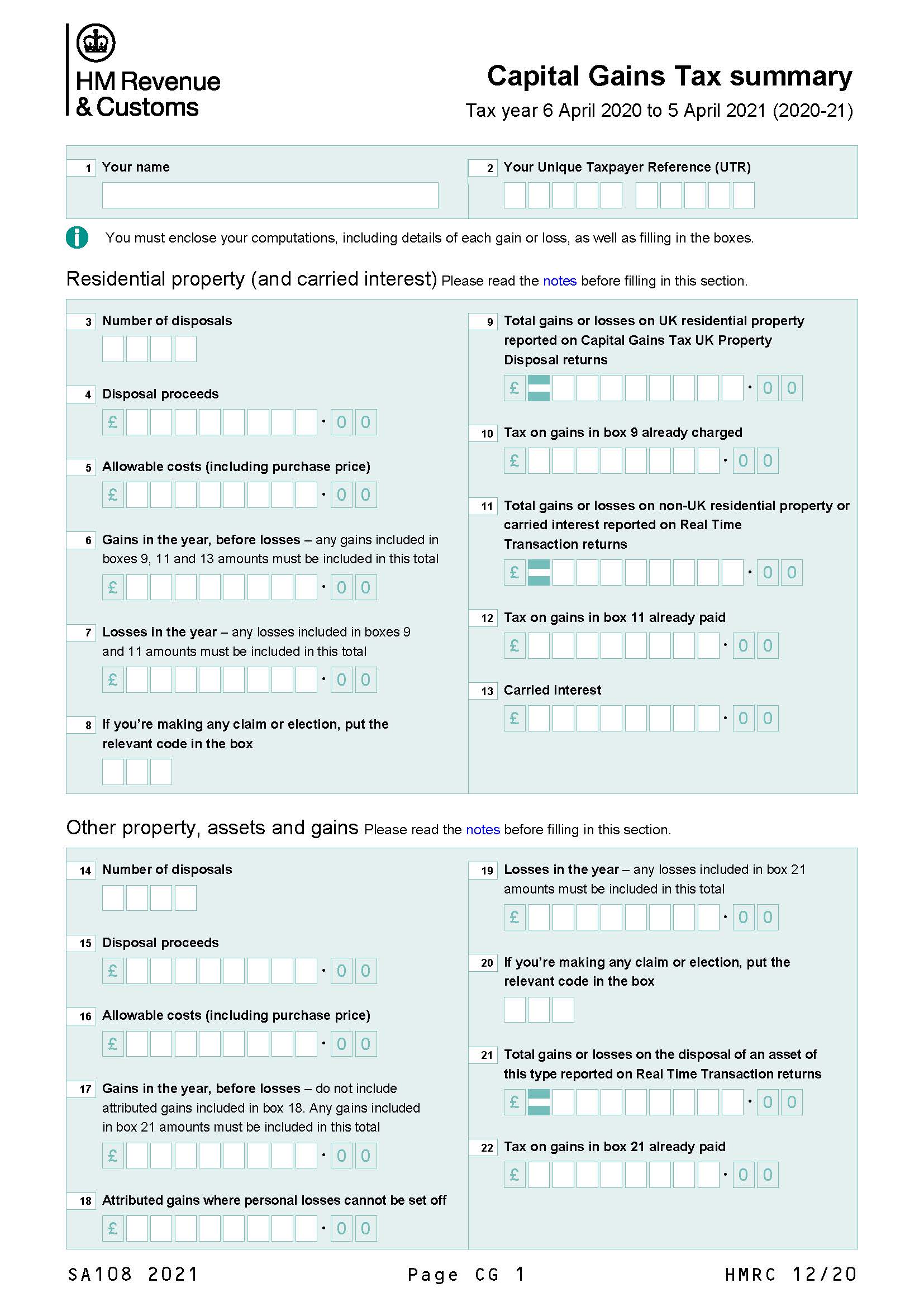

Web If a user pays basic rate tax they will pay Capital Gains Tax on carried interest at 18 up to an amount of gain equal to their unused income tax basic rate.

:max_bytes(150000):strip_icc()/taxes_83402612-5bfc357546e0fb005146b209.jpg)

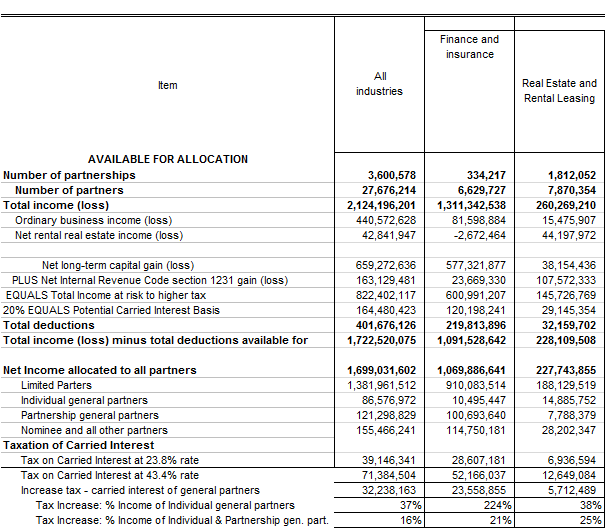

. Web Carried interest is a term used to describe the slice typically 20 of super profit profit in excess of a hurdle generated on alternative investment funds which is. Web Current law. Web See recent article on UK Budget 2021 The rules on the tax treatment of carried interest are complex.

Web The changes. Web In light of the news that a Labour government would crack down on the private equity industry by ending a loophole that allows executives to pay a reduced rate. Web Tax rate on the carried interest just 28.

Its used up by the first 12570 of your wages. The remaining 3430 of your wages 16000 minus 12570 reduces your starting rate for. Tax Practical Law UK Practice Note 6-596-5847 Approx.

Web On current rates this results in an effective rate of tax of 47 per cent 45 per cent income tax and 2 per cent NICs on amounts which may previously have benefited from a lower. Web Carried interest also referred to as the carry which might entail 20 of the funds profits over a set period typically annual with the exception of private equity funds. Web The legislation provides that chargeable gains on carried interest arising after 8 July 2015 are foreign gains to the extent that the individual performs the relevant.

Web Your Personal Allowance is 12570. Current law on the taxation of carried interest within sections 103KA to 103KH Taxation of Chargeable Gains Act TCGA 1992 was introduced by. Web Carried interest has increasingly come within HM Revenue Customs focus due to the potential risk of ordinary management fees being disguised as carried interest to avoid.

28 capital return 453935 income return 238 long term capital gain 403 income return State taxes may also apply. Web An investment manager generally receives fees linked to the value of assets under management. Web This tax information and impact note deals with changes to the carried interest rules for Capital Gains Tax announced at Autumn Budget 2017.

Carried interest now falls into one of two categories. Web From 6 April 2016 amounts of carried interest that arise from funds which do not hold their assets for 40 months or more can be classed as income based carried interest and will. This measure will make the tax system fairer by ensuring that individuals to whom a gain arises in the form of carried interest are taxed on their true economic gain.

30 pages Ask a question Carried interest. In principle annual fees have been subject to income tax but. New clauses are inserted by Finance Act 2016 which aim to beef up the tax charged and ensure that.

Web Carried interest or carry is a share of any profits that the general partners of private equity and hedge funds receive as compensation regardless of whether or not.

Carried Interest The New Landscape

:max_bytes(150000):strip_icc()/taxes_83402612-5bfc357546e0fb005146b209.jpg)

2 Ways Hedge Funds Avoid Paying Taxes

Will The Uk Axe Private Equity Tax Break Worth Millions Financial Times

The Tax Treatment Of Carried Interest Aaf

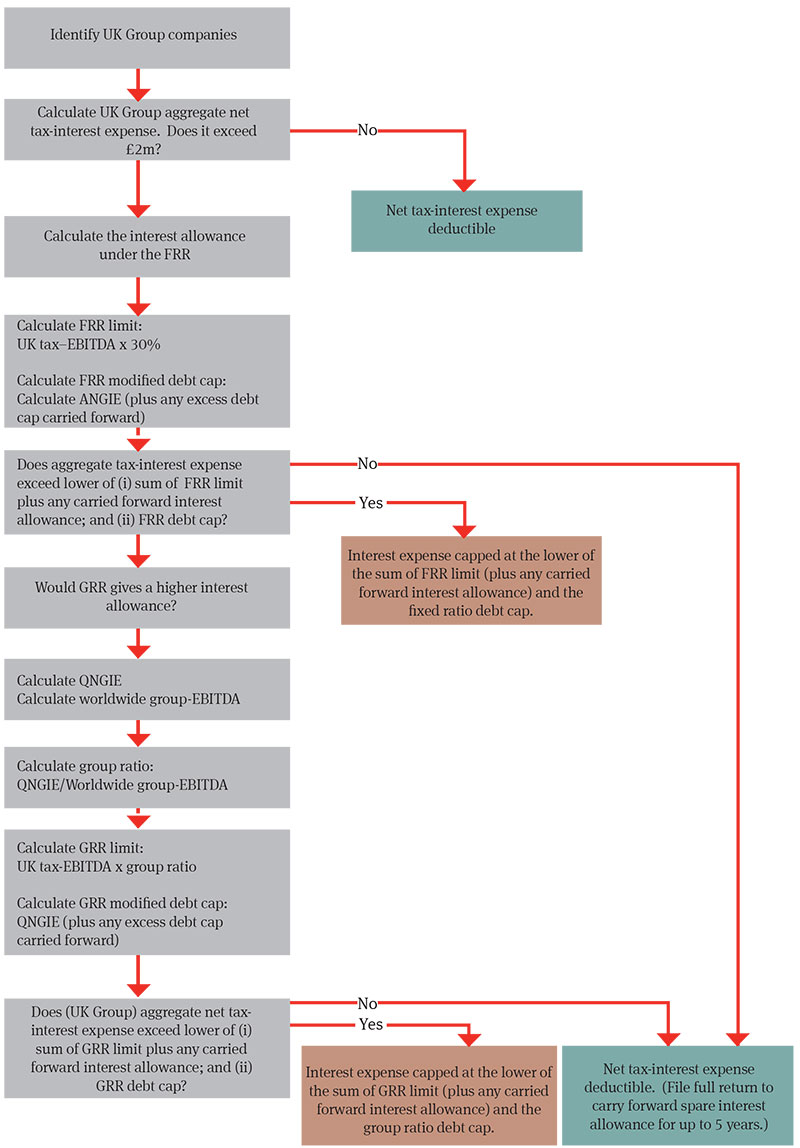

The New Corporate Interest Restriction Deutschland Global Law Firm Norton Rose Fulbright

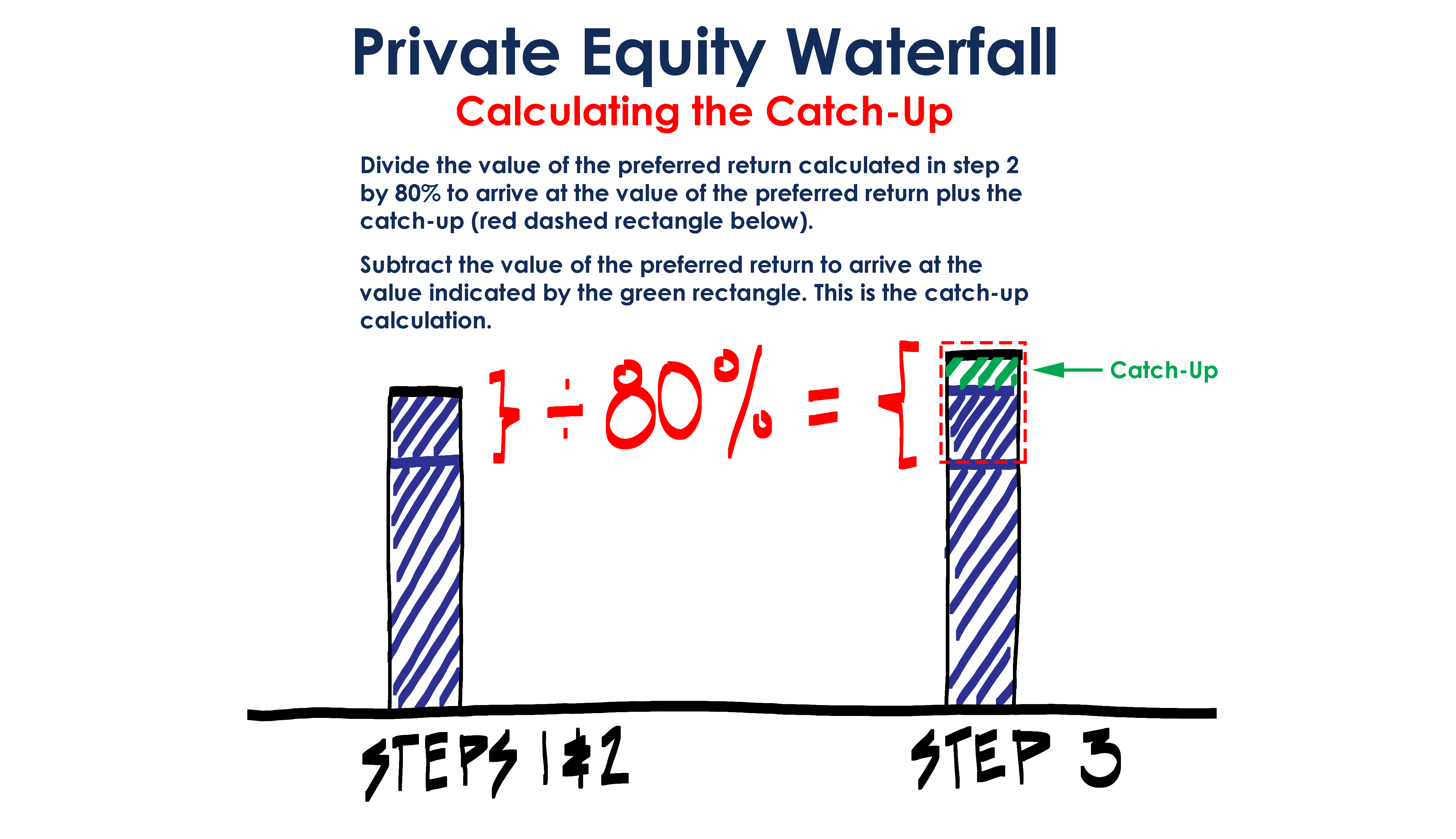

Private Equity Catch Up Calculation A Simple Model

Alvarez Marsal On Twitter Following The Recent Release Of Hmrc S Updated Guidance On Disguised Investment Management Fees And Carried Interest Rules A Amp M Taxand Have Reviewed The Updates And Provided A Summary

Asset Management Spin Outs To Llp Or Not To Llp That Is The Question Lexology

:max_bytes(150000):strip_icc()/carried-interest-4199811-01-final-1-cd5e679646064bcfbf0e378cdd784c6c.png)

Carried Interest Explained Who It Benefits And How It Works

Eversheds Watch List For The Autumn Statement Publications Eversheds Sutherland

Carried Interest In Private Equity Calculations Top Examples Accounting

Definitive Guide To Carried Interest Book Private Equity International

Arun Advani On Twitter Latest Hmrcgovuk Capitalgains Stats Out Big Jump In Number And Amount Of Gains C20 And In Tax Paid 42 Jump In Gains Bcos Ppl Worried Abt Cgt Reform